Navigating the world of international shipping isn't for the faint of heart. What might seem like a straightforward process of packing a box and printing a label quickly transforms into a complex dance of regulations, forms, and fees. At the heart of this complexity lie International Shipping, Customs, and Returns Policies – a triad that, if not understood and respected, can turn a simple transaction into a logistical nightmare.

From the small business owner sending a handcrafted item to a customer across the ocean to the individual mailing a personal gift, the details matter more than ever. Forget generic descriptions or vague values; today, customs officials demand precision, and your customers expect clarity on everything from delivery timelines to return procedures. This isn't just about compliance; it's about building trust, preventing delays, and avoiding costly mistakes that can erode your profit margins and damage your reputation.

At a Glance: Key Takeaways for International Shipping Success

- Detail is Non-Negotiable: Every item needs a specific description (what it is, what it's made of, its purpose). Vague terms lead to delays or rejection.

- Customs Forms Are Mandatory: Nearly all international packages require one. Know which form is needed for your service and value.

- HS Codes Matter: Harmonized System (HS) Tariff Codes streamline customs. Accurate item descriptions help assign the right code, preventing holdups.

- Duties & Taxes are Extra Costs: Understand Delivered Duty Unpaid (DDU) vs. Delivered Duty Paid (DDP) to manage customer expectations and avoid surprise fees.

- International Returns Are Complex: Planning for returns is crucial, factoring in costs, re-import duties, and unique customs procedures.

- Leverage Carrier Tools: Services like USPS Click-N-Ship and UPS.com offer valuable online resources for form completion and guidance.

The Global Shipping Maze: Why Detail Isn't Just a Suggestion

Imagine trying to navigate a bustling international airport, but instead of clear signs, everything is labeled "stuff" or "things." That's often what customs officials face with inadequately described packages. Global trade is a marvel of interconnectedness, yet each country maintains its sovereignty through specific import laws, taxes, and prohibitions. These regulations exist for economic, security, and safety reasons, designed to protect local industries, prevent illicit trade, and ensure hazardous materials don't enter the country.

This is why the days of simply writing "gift" or "miscellaneous goods" on a customs form are long gone. Authorities worldwide, including the USPS, have tightened requirements for content descriptions. They need to know exactly what's crossing their borders to assess duties, identify restricted items, and manage national security risks. Failure to meet these heightened requirements can lead to more than just a minor hiccup; your package could be rejected, returned to sender, or, in the worst-case scenario, destroyed. For businesses, this means lost revenue, frustrated customers, and reputational damage. For individuals, it's the heartache of a lost birthday present or a delayed care package.

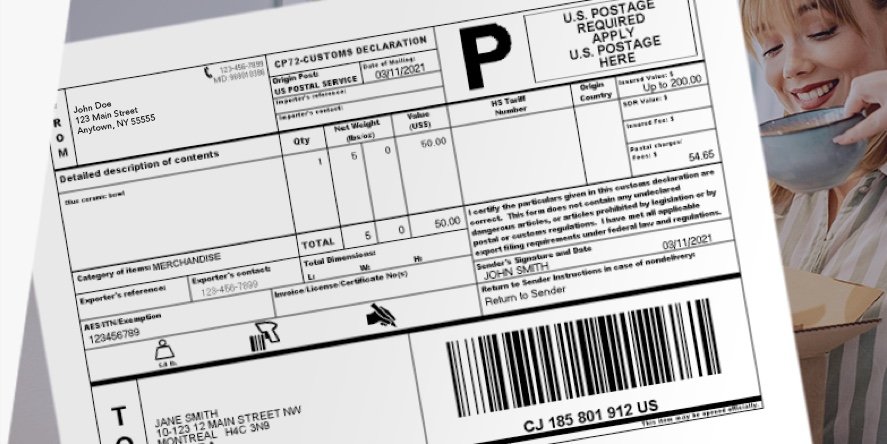

Decoding the Customs Form: Your Passport to Cross-Border Trade

Think of a customs form as the passport for your package. It's the official declaration to the destination country's government about what you're sending. Without a properly completed form, your shipment won't get far.

It's Not Just Paperwork, It's Crucial Documentation

Customs forms are mandatory for almost every item shipped from the U.S. to another country. The only common exception, as noted by the USPS, is First-Class Mail International letters and large envelopes under 15.994 oz containing only nonnegotiable documents. For everything else – from a small personal gift to a multi-item e-commerce order or even military mail (APO/DPO/FPO) – a customs form is a must.

The specific form you'll need varies by the mail service you choose and the total value of your shipment. But regardless of the form, the core information required remains consistent, and accuracy is paramount. Incorrect or incomplete information doesn't just delay a package; it can trigger a full-blown inspection, additional fees, or lead to its outright rejection.

The Golden Rule: Specificity in Item Descriptions

This is where many shippers stumble. The new, stricter requirements demand an almost forensic level of detail for each item within your package. According to USPS guidelines, every item's description must clarify three key things:

- What the item is: Instead of broad categories, be precise. For instance, "electronics" is out; "laptop computer" or "mobile phone" is in. Don't say "clothing"; say "Men's cotton shirts" or "Child's knitted wool sweater." If you're sending a food item, specify "roasted coffee beans" instead of "food."

- What it's made of: Material composition is crucial for classification and, often, for determining duties. For example, specify "silver necklace" instead of "jewelry," or "wooden carving" instead of "art." If it's a textile, note "100% cotton," "polyester blend," or "linen."

- What its purpose is: Is it for personal use, a retail sale, a sample, a repair, or a gift? This distinction affects how customs treats the item and whether duties might apply. For instance, declaring "used auto part for repair" is far more informative than just "auto part."

More Examples to Guide You:

- Instead of "Books," specify: "Paperback fiction novels, for personal reading."

- Instead of "Toys," specify: "Plastic action figures, new, for retail sale."

- Instead of "Vitamins," specify: "Dietary supplement, Vitamin C tablets (1000mg), 90 counts, for personal consumption."

- Instead of "Handmade item," specify: "Hand-painted ceramic mug, stoneware, for personal gift."

Why this level of granularity? Customs officials need this information to correctly assign Harmonized System (HS) codes, apply the right tariffs, and ensure compliance with import restrictions. It’s also vital for security screenings, allowing them to quickly identify potentially hazardous or prohibited items. Skimping on details here is a guaranteed way to invite delays and scrutiny.

Unmasking the HS Code: The Universal Product Language

You might encounter the term "Harmonized System (HS) Tariff Codes" when shipping internationally. These are 6-to-10-digit identifiers for goods, a global product nomenclature developed by the World Customs Organization (WCO). Think of them as the universal language for goods, understood by customs authorities worldwide.

Why They Matter:

HS Codes are critical because they:

- Streamline Customs Processing: They quickly tell customs what your item is, speeding up clearance.

- Determine Duties and Taxes: Tariffs are directly tied to these codes.

- Improve Cross-Border Efficiency: Everyone in the logistics chain understands the item's classification.

- Enhance Safety and Security: They help identify regulated or dangerous goods.

While customers are ultimately responsible for accurately describing items, services like USPS can assist in assigning the correct HS Code based on your detailed description. You can also look them up independently, though it's a complex system, updated every five years, with unique country sub-classifications (the U.S., for example, adds further digits to the 6-digit international standard, totaling 10). The complexity, frequent revisions, and country-specific nuances are why providing a meticulous item description is your best first step.

Actionable Tip: Even if your carrier assigns the HS Code, understanding its purpose and checking if it aligns with your detailed description can help prevent issues down the line. If you're shipping commercially, investing time in understanding HS codes for your specific products can save you significant time and money.

Beyond the Description: Every Detail Matters

Beyond the item description, customs forms require a comprehensive set of information about both the sender and recipient, as well as the package itself. No abbreviations are allowed for names and addresses, emphasizing clarity and reducing ambiguity.

- Sender Information: Your complete first name, last name, full road name and number, ZIP Code™, city, state, phone, and email. This ensures the package can be returned if undeliverable and allows customs to contact you if there are questions.

- Recipient Information: The exact same level of detail for the person receiving the package. An incorrect digit in a phone number or a typo in a street name can easily lead to a failed delivery.

- Item Value: A separate, specific value for each item in the shipment, plus a total shipment value. This is crucial for customs to assess duties and taxes, and also for insurance purposes. Be honest; under-declaring value can lead to severe penalties.

- Packet or Package Weight: The total gross weight of the package and the unit of calculation (e.g., pounds or kilograms). This affects shipping costs and can be another data point for customs.

- Country of Origin: Often overlooked, this refers to where the goods were produced, not just where they are shipped from. This information is vital for trade agreements, quotas, and specific import regulations.

How to Complete Your Customs Forms: Online vs. In-Person

Gone are the days when manually filling out a multi-part form was the only option. Today, online tools offer significant advantages:

- Online Convenience: Services like USPS's Customs Form Online allow you to print just the customs form, while Click-N-Ship® lets you pay for postage and print an international shipping label that includes the customs form. This integration simplifies the process for services like First-Class Package International Service®, Priority Mail Express International®, and Priority Mail International®. Online tools typically guide you step-by-step, helping reduce errors and ensuring all required fields are completed. UPS also offers a robust online shipping application designed to simplify international shipments, guiding you through necessary forms like commercial invoices.

- At a Post Office: If you're using postage stamps or specific services not available online, you'll still need to visit a Post Office™. You'll fill out a form like PS Form 2976-R (used for Priority Mail Express International® and other USPS international services, including APO/FPO/DPO mail) and present your package to a clerk. They will then affix the appropriate customs form.

Actionable Insight: Before shipping, always consult individual country listings for specific customs requirements. Every nation has its unique quirks, prohibitions, and restrictions, and what's permissible in one might be forbidden in another. Taking a few extra minutes for this research can save days, if not weeks, of delays.

The Real Cost of Global Shipping: Duties, Taxes, and Incoterms®

When you send a package internationally, the postage you pay covers the carrier's fee to transport your item. It generally doesn't cover the duties, taxes, and import fees levied by the destination country's government. This is a crucial distinction that often catches both shippers and recipients by surprise.

- Duties (Tariffs): These are taxes imposed on goods imported into a country. They are typically calculated as a percentage of the item's value and are based on the item's classification (HS Code), its country of origin, and various trade agreements.

- Taxes: Similar to sales tax or VAT (Value Added Tax), these are consumption taxes applied to most goods and services within a country, including imports.

- Import Fees/Brokerage Fees: Carriers or customs brokers might charge additional fees for processing customs paperwork, handling the payment of duties and taxes, or for specific services required to clear your package.

The critical question then becomes: Who pays these additional costs? This is where understanding Delivered Duty Unpaid (DDU) versus Delivered Duty Paid (DDP) becomes essential. - Delivered Duty Unpaid (DDU): In a DDU scenario, the recipient is responsible for paying all duties, taxes, and any associated import fees upon arrival. The package arrives in the destination country, customs assesses the charges, and the local post office or courier contacts the recipient to collect these fees before releasing the package.

- Pros for Seller: Simpler upfront for the seller, as they don't need to calculate or collect these fees.

- Cons for Buyer: Can lead to "sticker shock" for the buyer, creating a negative customer experience, potential refusal of package, and costly returns for the seller.

- Delivered Duty Paid (DDP): With DDP, the seller takes responsibility for calculating, collecting, and paying all duties, taxes, and import fees upfront. These costs are typically included in the final price the customer pays at checkout or are charged as a separate "duties and taxes" line item.

- Pros for Buyer: A seamless experience; they know the total cost upfront, with no surprises upon delivery.

- Pros for Seller: Better customer satisfaction, fewer refused packages, and often faster customs clearance.

- Cons for Seller: More complex to implement, requiring accurate calculation of duties/taxes for various countries.

The choice between DDU and DDP significantly impacts customer experience and your logistical burden. For most e-commerce businesses, opting for DDP (or at least making it an option) is highly recommended to build trust and prevent abandoned orders.

Incoterms® Simplified: Clarifying Responsibilities

Incoterms® (International Commercial Terms) are a globally recognized set of rules that define the responsibilities of sellers and buyers for the delivery of goods under sales contracts. While primarily used for large commercial shipments, understanding their concept helps clarify who is responsible for what, when, and where—including costs like duties and taxes.

Terms like "Ex Works (EXW)," "Free On Board (FOB)," and "Delivered Duty Paid (DDP)" allocate responsibilities for freight costs, insurance, and yes, customs clearance and payment of duties. UPS, for instance, touches upon the role of Incoterms® in determining who pays what. For smaller shipments, the DDU/DDP distinction is often more immediately relevant, but knowing that these internationally agreed-upon terms exist underscores the importance of clearly defining responsibilities.

Choosing Your Global Courier: More Than Just a Price Tag

Selecting the right carrier for international shipping is a strategic decision that balances cost, speed, tracking capabilities, and customer support. While major players like USPS, UPS, FedEx, and DHL all offer international services, their strengths and specialties can vary.

- USPS (United States Postal Service): Often the most cost-effective option for smaller, lighter packages, especially for less urgent deliveries. Their services like First-Class Package International Service® and Priority Mail International® offer varying speeds. As detailed in their guidelines, USPS provides online tools like Click-N-Ship® that integrate customs form completion with postage payment, simplifying the process for individuals and small businesses. Their extensive global network makes them a reliable choice for reaching almost any corner of the world.

- UPS (United Parcel Service): Renowned for its robust tracking, speed, and dedicated resources for international shipping. UPS offers a wide array of services, from urgent express options to more budget-friendly choices like UPS Worldwide Economy. Their website provides comprehensive international shipping guides and resources, offering step-by-step assistance for utilizing their shipping application, understanding customs procedures, and navigating commercial invoices and other forms. They are particularly strong for businesses requiring advanced logistics, insurance, and reliable, time-definite deliveries. For anyone interested in streamlining their international shopping experience, exploring carrier options and their features is key. Your guide to shopping in English provides broader insights into navigating global marketplaces and understanding different shipping options available to consumers.

- Other Major Carriers (FedEx, DHL): Like UPS, these carriers offer extensive global networks, advanced tracking, and a range of express and economy services suitable for various business needs. They often excel in specific regions or for particular types of cargo, making it worthwhile to compare their offerings based on your common destinations and package profiles.

Key Decision Factors for Your Carrier: - Speed: How quickly does the package need to arrive? Express services are faster but more expensive.

- Cost: Compare rates for different services and carriers based on your package's weight, dimensions, and destination.

- Tracking: How detailed and reliable is the tracking information?

- Insurance: What coverage is offered, and what are the limits?

- Customs Support: Does the carrier offer tools or assistance with customs documentation?

- Destination: Some carriers might have better service or rates to specific countries.

The Return Journey: Crafting a Bulletproof International Returns Policy

While shipping a package out is one challenge, getting it back in case of a return can be an even greater one. International returns are notoriously complex and can quickly erase any profit from an initial sale if not managed effectively.

Why International Returns Are Different

- Exorbitant Shipping Costs: Return shipping can often be as expensive as, or even more than, the original outbound shipment, especially for bulky or heavy items.

- Re-Import Duties/Taxes: If the item being returned was originally subject to duties and taxes, you might face re-importation fees when it re-enters your country, or face difficulties getting a refund for the duties paid to the destination country.

- Customs Paperwork, Again: A returned item requires its own customs declaration, often needing specific markings (e.g., "returned goods," "failed delivery") to signal to customs that it's not a new import subject to new duties.

- Extended Transit Times: The reverse journey can be just as slow, if not slower, than the original, leading to long waits for refunds and potential customer dissatisfaction.

- Environmental Impact: High return rates contribute to increased carbon footprint.

Essential Elements of Your International Returns Policy

A clear, unambiguous international returns policy is not just good customer service; it's a necessity for managing expectations and costs.

- Clear Eligibility Criteria: Define precisely what can be returned.

- Timeframes: How many days do customers have to initiate a return? (e.g., "within 30 days of delivery").

- Condition of Item: Must it be unused, unworn, with original tags? What about damaged items?

- Non-returnable Items: Clearly list anything that cannot be returned (e.g., personalized items, digital goods, perishable goods, final sale items).

- Who Pays for Return Shipping: This is a major point of contention.

- Buyer Pays: Common for "change of mind" returns, but can deter international customers.

- Seller Pays: A strong customer service move, but expensive.

- Shared Cost: A compromise, e.g., seller pays for faulty goods, buyer for preference.

- Refund Process and Scope: What exactly will be refunded?

- Item Value Only: Often, the original shipping cost is non-refundable.

- Original Duties/Taxes: Can the customer get a refund for the duties/taxes they paid to their government? This varies by country and often requires the customer to apply directly to their customs authority, which can be complex. Your policy should clearly state this.

- Refund Method: How will the refund be issued (original payment method, store credit)?

- Customs Declaration for Returns: Crucial for avoiding double taxation. Instruct customers to:

- Mark the package clearly as "RETURNED GOODS" on the customs form.

- Include the original tracking number and invoice if possible.

- Declare a nominal or zero value if it's a genuine return (to avoid new duties on re-import), but always be truthful about the item's nature.

- RMA (Return Merchandise Authorization) Process: Provide a step-by-step guide for customers to initiate a return. This might involve contacting customer service, receiving a unique RMA number, and getting specific shipping instructions.

- Addressing Lost or Damaged Returns: What is your policy if a returned item is lost or damaged in transit? Does the customer bear the risk?

Practical Tip: For low-value items or returns from particularly difficult destinations, consider offering a partial refund without requiring the item to be shipped back. The cost of reverse logistics might outweigh the product's value. Also, be mindful of consumer protection laws in the recipient country, such as the EU's distance selling regulations, which may grant customers a "right to withdraw" regardless of your policy.

Navigating the Nuances: Best Practices for Seamless Shipments

Mastering international shipping is an ongoing process of learning and adapting. Here are some best practices to ensure smoother journeys for your packages:

- Consult Country-Specific Regulations: This cannot be overstressed. Every country has unique prohibitions (e.g., certain foods, electronics, literature) and restrictions. The USPS and UPS websites offer country-specific guides that are invaluable. Ignoring these is a surefire way to have your package confiscated or returned.

- Leverage Carrier Tools and Resources: Don't try to navigate the complexities alone. Utilize the comprehensive guides, online forms, and customer support offered by your chosen carrier. UPS's international shipping guides, for example, provide detailed information on everything from commercial invoices to Incoterms®.

- Communicate Clearly with Your Recipients: Proactively inform your international customers about potential customs delays, the possibility of duties and taxes (and who is responsible for them), and your detailed returns policy. Transparency builds trust and reduces customer service inquiries. Include clear tracking information and instructions on what to do if contacted by customs.

- Insure Valuable Shipments: International travel exposes packages to more handling and potential risks. Protect your investment (and your customer's) with adequate insurance coverage.

- Keep Meticulous Records: Retain copies of all customs forms, tracking numbers, invoices, and any communications with carriers or customers regarding international shipments. This documentation is invaluable if a package is delayed, lost, or subject to a customs inquiry.

- Package for the Journey: International shipments endure more rigorous handling than domestic ones. Use sturdy boxes, ample cushioning, and secure sealing. Consider the climate and potential rough treatment your package might encounter.

Your Action Plan for Global Success

Embarking on international shipping doesn't have to be a journey into the unknown. With meticulous preparation, clear communication, and a commitment to detail, you can transform these complexities into a competitive advantage.

- Before You Ship:

- Research: Always begin by checking the destination country's specific import regulations and prohibited items.

- Choose Wisely: Select a carrier service that balances cost, speed, and reliability for your needs.

- Prepare Thoroughly: Gather all necessary sender/recipient information and craft incredibly detailed item descriptions for your customs forms. Don't guess; be precise.

- During Shipment:

- Track Diligently: Keep an eye on your package's journey and be prepared to respond quickly if customs or the recipient contacts you with questions.

- Post-Shipment:

- Follow Up: For commercial shipments, consider a follow-up with the customer to ensure satisfaction.

- Refine: Learn from each international shipping experience. Update your product descriptions, refine your packaging, and adapt your returns policy based on feedback and real-world outcomes.

While "International Shipping, Customs, and Returns Policies" might sound like a bureaucratic tangle, they are ultimately the rules of engagement for participating in the global marketplace. By understanding and respecting them, you're not just moving goods; you're building bridges, fostering relationships, and expanding your reach in an increasingly interconnected world.